When we examine clients in the financial advisory industry, we notice that the average age tends to be pretty close to that of the average advisor age (roughly 60 years old) – according to a 2017 McKinsey report, the average client age was 64.2 years old (up from 63.6 in 2014).

Interestingly enough, Gen Xers and millennials are expected to control 47% of wealth in the United States by 2030 (FYI - the oldest Gen Xers are turning 56 this year). In fact, the younger generations’ wealth will only increase as they inherit a “significant share of the $24 trillion expected to be passed down in the next decade,” according to a T. Rowe Price study.

These statistics make it glaringly obvious that advisors need to get better at finding, attracting, and working with younger clients.

Retirees: A Depreciating Asset?

Working with older clients is desirable for obvious reasons – they have more wealth (compared to those in the accumulation phase) that immediately generates higher revenues.

But older clients tend to be more conservative, there’s an eventual lack of ongoing contributions, and obviously, they begin to start making withdrawals. When these clients shift to spending rather than saving, there can be a concern that the practice may become a depreciating asset (more assets/revenue are leaving through distributions than new assets coming in).

When you look at the stats though, it may not be as much of a concern as you’d think. For example, if a balanced portfolio averages 8% and the withdrawal rate starts at only 4%, most clients will still end up out-earning their spending level. Additionally, their remaining wealth is still compounding upwards rather than spending down. At this rate, it’s extremely unlikely that ongoing retirement withdrawals will completely deplete a retiree’s asset base before the final years of retirement (age 80+).

Building your practice around retirees will probably mean that your business grows at a slower pace than one built around accumulators, but the impact on most practices is expected to be modest over the next decade.

Death is a Greater Concern

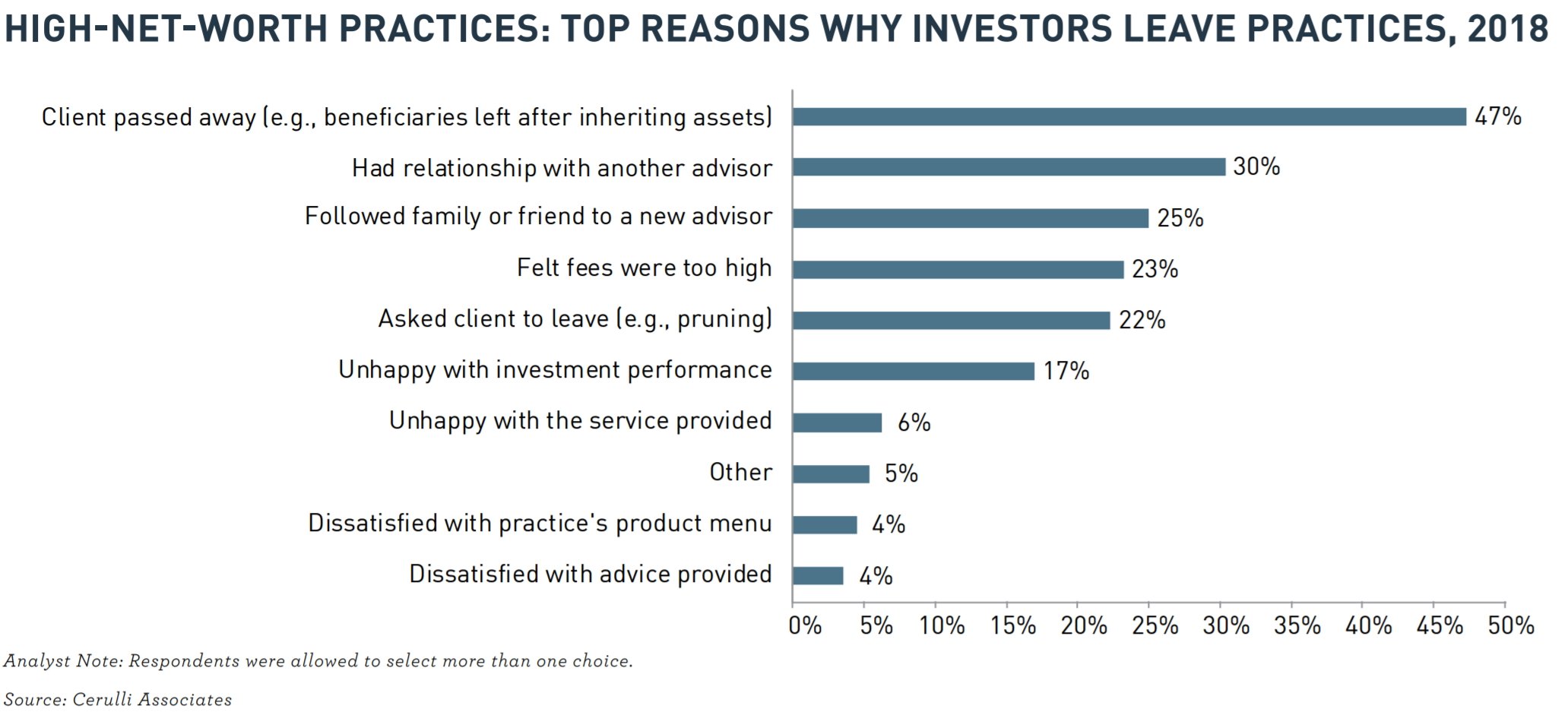

The greater concern with retirees should be death (not distributions). According to a 2019 Cerulli Associates report 47% of client attrition is due to death.

It’s a sobering fact - almost half of HNW practices cite beneficiaries choosing to depart after inheriting assets as a top reason that investors leave their practices.

There’s an additional nuance to this that many advisors overlook – that of the relationships with surviving spouses. Just a few decades ago, husbands were thought to be the financial decision makers in the household; and taking the time to also build a relationship with a wife was often neglected.

Today, data shows that 70% of all widows fire their wealth advisor within one year of their husband’s death (coincidentally, in Canada it’s 80%)! When you take into consideration that 70% of all married baby boomer wives will experience widowhood, the importance of building a relationship with both members of a couple increases exponentially. And keep in mind too that many women will be dual inheritors, not just receiving assets from her deceased spouse, but also her parents.

Bottom line, build relationships with ALL clients and their next of kin.

The Next Generation of Clients

As far as that next generation goes, specifically targeting younger clients who are in the accumulation phase ultimately benefits a firm’s long-term growth (you’ll grow more rapidly) and value. It’s usually not an ideal strategy for someone who is looking to retire in the next few years – it’s best geared for an advisor who wants to serve those clients profitably over the long run.

Not surprising however, is that firms with the highest revenue growth had the largest percentage of clients under 55. The previously mentioned T. Rowe Price study found that 37% of clients at firms in the top quartile of revenue growth fell into this age range. Only 12% of clients at bottom-quartile firms were 55 or younger.

Attracting Younger Clients

Just setting your mind out to attract younger clients isn’t going to be enough; it will require a deliberate marketing plan and approach. Think about going where the money will be, not where it is today.

These clients don’t look (or act) like your current client base! The next generation thinks about wealth differently (they don’t see themselves as wealthy). oftentimes they’re not sure if they’re qualified to work with a financial advisor; that advisors won’t want their business!

Try to adopt the mind frame of a young investor – understanding their challenges and concerns, and the different kinds of needs they have will be critical to your success.

Eliminate the Use of Jargon

Younger generations talk differently than the clients you’re used to communicating with; they don’t understand industry jargon and they’re sometimes embarrassed to ask what it means. You need to be able to clearly and effectively communicate with them. Consider adjusting your marketing language when working with this client segment. Avoid confusing language and proactively explain financial terms in layman’s terms to avoid alienating younger prospective clients.

Review the Use of Technology

It’s amazing to watch younger generations – especially young children! – use technology. Those under the age of 40 are much more savvy, so your use of technology will need a review and potential update to meet their expectations (this means you’ll need to re-evaluate and adapt every few years too going forward!).

This age group is accustomed to shopping around to find the best deal. And they often turn to Google for answers to their questions and to find an advisor. Make sure your Search Engine Optimization is up to par. Referrals are still the main way that clients find financial advisors, but the internet is a close second, especially for younger generations.

Bridge the Existing Generational Gap

Your existing client base holds a treasure trove of next gen prospects – make it a point to work with multiple generations of the same family to secure assets as wealth transitions. Intergenerational conversations around inheritance tax and estate planning allow advisors to design financial plans that include everyone and help you build relationships with future clients.

Remember too that today’s schools don’t teach children about money or financial planning – many college students have no idea how to balance a checkbook! Offer low-key educational sessions to your clients’ children (even if it’s one-on-one with their parents). The earlier you start, the stronger those relationships will be. It’s an investment in the future that will take some time to pay off, but it’s low-hanging fruit and something that is often overlooked.

Diversify Your Team

Let’s be honest – young clients generally don’t want to work with an older advisor. As you introduce a younger generation of clients to your practice, consider adding younger advisors as well to support them. It may be wise to follow a “built it and they will come” mentality and add younger staff before you even target this segment to increase your likelihood of success. Younger advisors will be in a better position to relate to their goals and struggles of their peer group, and help secure the strength of those relationships.

Be a Financial Coach, Not an Advisor

As previously mentioned, younger clients have different priorities than traditional wealth management clients. Advisors that overemphasize retirement or estate planning risk losing younger clients with different needs and concerns – those concerns include buying a home, paying for a child’s tuition, taking care of an aging parent, and making sure their family is protected in the event of death or disability.

Overall, younger clients tend to be more focused on financial advice and tax planning, rather than investment performance. They desire guidance on their entire financial life, not just their portfolios. Remember too that this generation treats spending differently – recommendations that worked for their parents around eliminating “luxury” expenses (even something as simple as getting Starbucks every day) may turn off younger clients. They know they need to be saving and investing; they just don’t know how to do it.

Re-Evaluate Fee Structures

The way people pay for services has radically evolved in recent years… except for the wealth management industry (where most advisors still focus on asset-based fees). Unfortunately, this “one size fits all” approach does not work for the younger generation – the pricing models don’t always make sense.

If you want to best appeal to younger clients, get creative with your fees! Consider monthly or annual flat fees – or even a “pay for advice” or a subscription service for financial guidance. Review your fee structure and consider adding different levels of service at different price points.

Make no mistake, there is a gap (i.e., an opportunity!) in the market for the 28-42 year old age range. With careful planning and a deliberate approach, you can capitalize on the opportunity and increase the stability (and value) of your practice. Having a healthy mix of client ages helps ensure that your practice will be more successful - that your revenue will grow faster and that your business will be able to more easily perpetuate into the future.

These Stories on Client Management