The very first change you'll notice is that the order of our intake has changed. We used to go from Firm Details into Owners and Advisors. We decided to move Revenue and Clients up in the order because of how strongly those intake sections are tied with industry-specific questions answered on the Firm Details intake section.

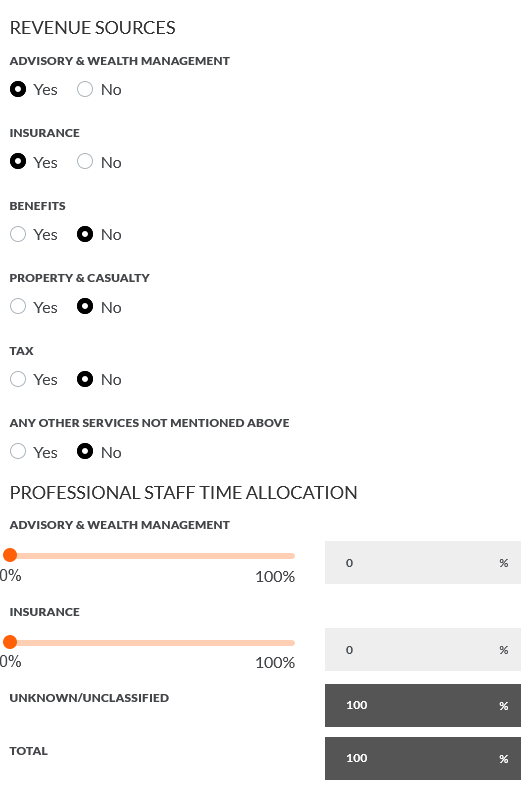

You should feel at home with the Firm Details intake section. The only change is the addition of the questions shown above. First off, we ask you what industries you operate in. This helps us customize the rest of the intake based on your unique business and product mix. As an example of this, you'll see we only said "Yes" to the Advisory and Insurance industries; and as such, in the Professional Staff Time Allocation questions, we only show intake questions around those two industries. This same theme will follow throughout the rest of the intake process. At any time, you can come back to the Firm Details section and change your industry selections, and your intake experience will change accordingly.

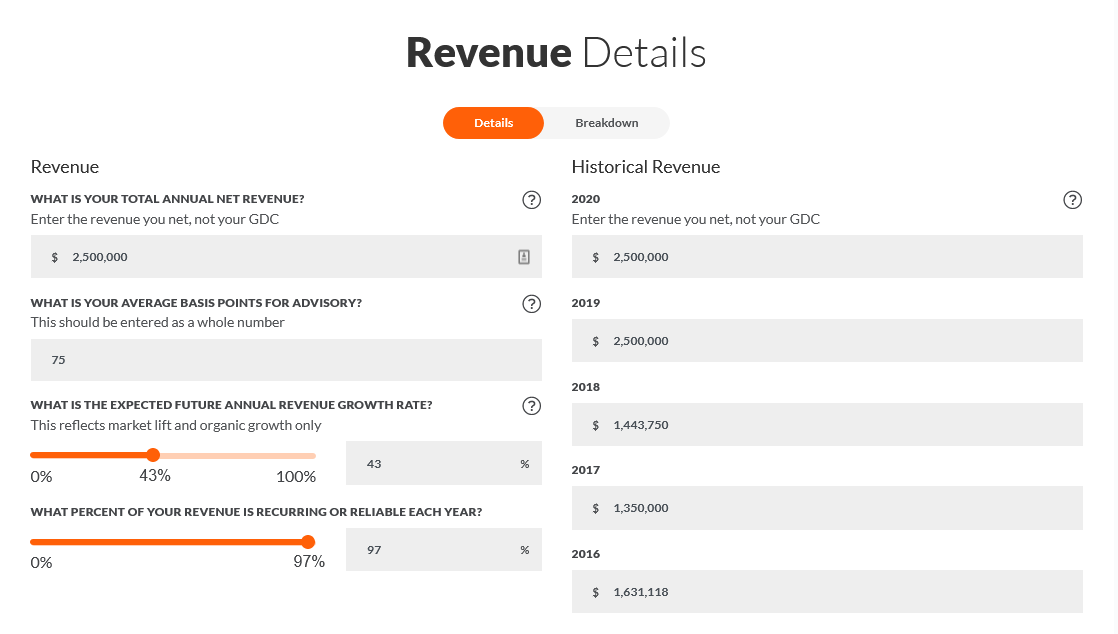

You'll definitely notice some changes to this section! First of all, we split the page into two sub-sections: Details and Breakdown. On the Details section, you'll find some basic questions about revenue at a high level. These questions already existed and shouldn't be anything new.

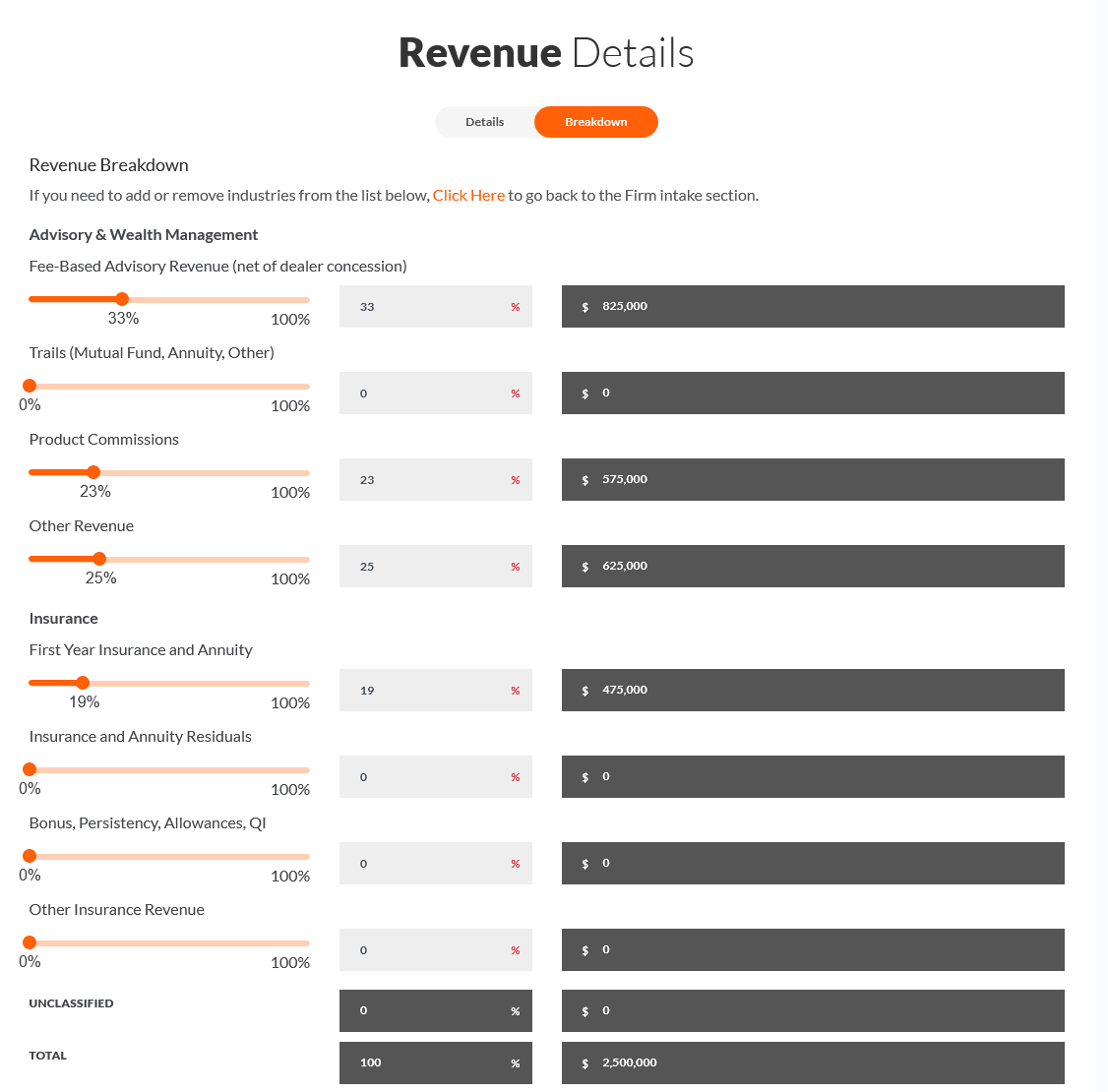

You should also feel fairly at home with the Breakdown section, but with three changes:

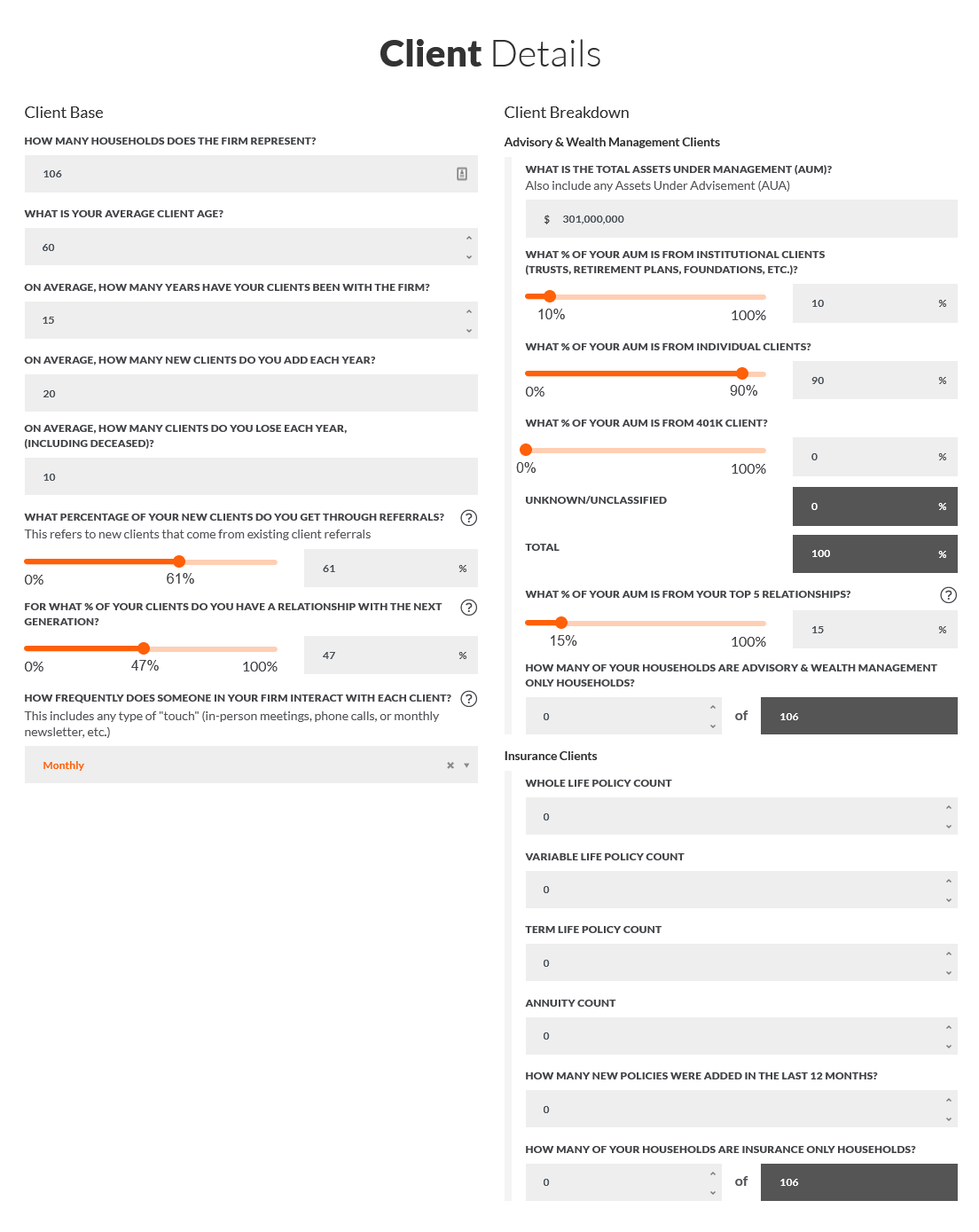

The Client intake is probably the intake section with the most changes. And while this page might feel daunting at first, don't fret. It's actually not that bad... we promise!

On the left will be all the questions you're already used to with our intake. They're questions that are relevant to your business, regardless of your product mix. The right side, then, is specific to your product mix. The more industries you sell into, the more questions you'll have to answer. But don't worry, because the questions are pretty basic and easy to answer.

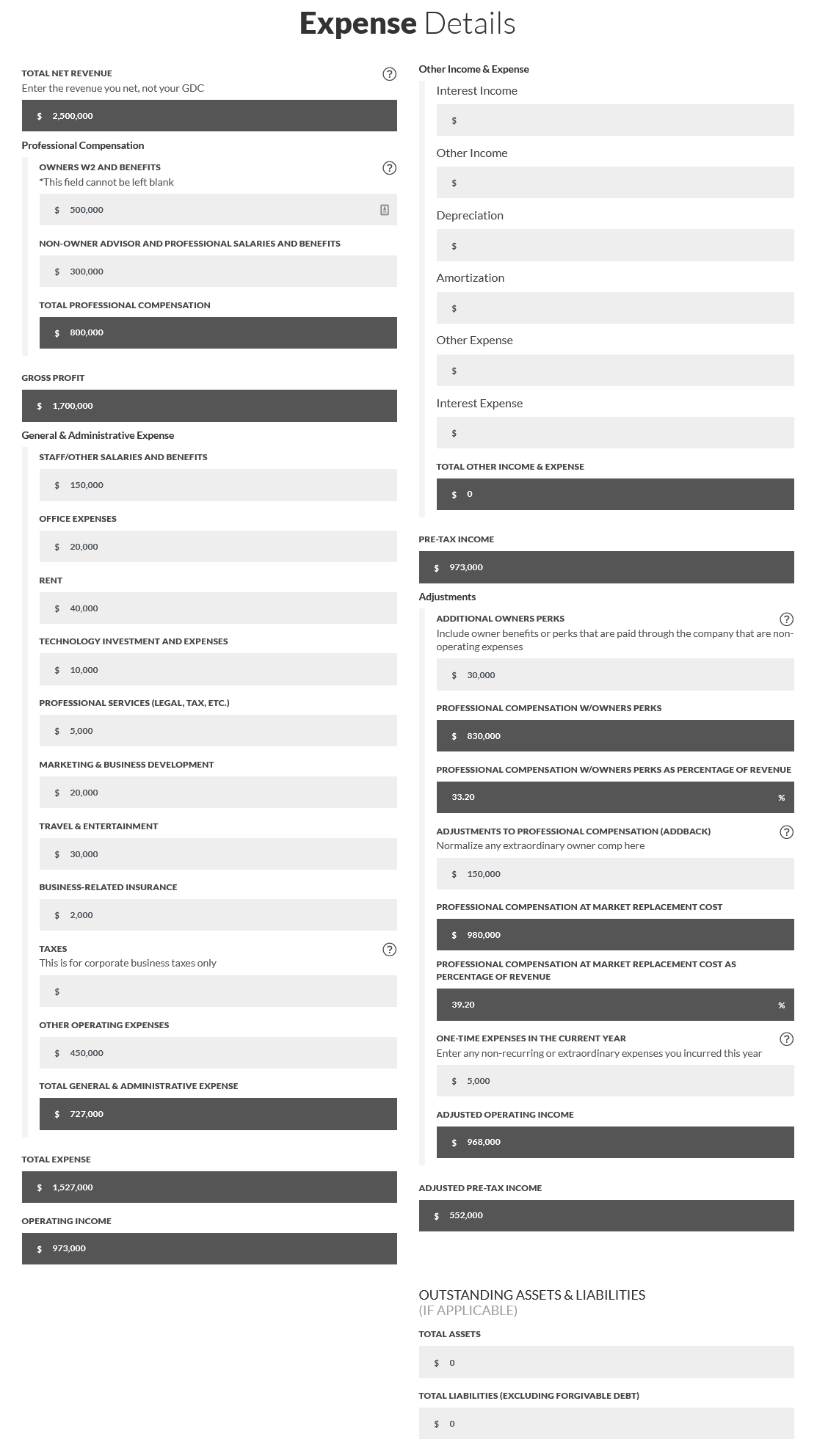

The last set of changes worth bringing to your attention is on the Expenses page. We didn't add any new intake questions here. Instead, we took your feedback and re-organized things to fit more closely with how you work with a P&L for your business. We also added a few calculated fields along the way just to help you double check your values.

So why did we make these intake changes? Great question! It's not just because we love data (although we do!). It's because we wanted to give you more flexibility in describing your business so that we can, in return, offer better output reports and more insights into your business. In addition to adding a dozen new KPIs across our scorecards, we've also made our model much more sophisticated. It now better understands your industry and product mix. It knows when you're too highly dependent on one industry or one type of product and will warn you. It can now include or exclude certain KPIs based on your inputs, so not to show KPIs irrelevant to your business. It uses all of these changes to give you a more in-depth discount rate for your DCF. And it wraps all of this up and packages them in the most robust and transparent eValuation PDF and Snapshot report we've ever offered.

And as always, if there’s something that you’d like to see, please feel free to reach out and let us know.

These Stories on Product Release Notes