A valuation provides so much more than just a calculation of a firm’s value. Instead it can serve as a valuable practice management tool that provides a complete “physical examination” for your business. Imagine a thorough health record for your business that tracks what is the equivalent of your firm’s heart rate, blood pressure, cholesterol levels, etc. When you have this level of depth in an assessment of your business, you’re able to discover what really drives value and understand how these metrics can effect small changes to your business that will yield significant results.

Contrary to popular industry belief, simply multiplying revenue by some random formula usually isn’t accurate enough to reveal true enterprise value. As a business owner, you know that every dollar of revenue has an expense tied to it; but valuations go well beyond that of just a business’s financials. Rather, it’s important to understand the underlying value drivers of a business. These are oftentimes the unique set of factors (the non-financial and intangible aspects) that make every business different.

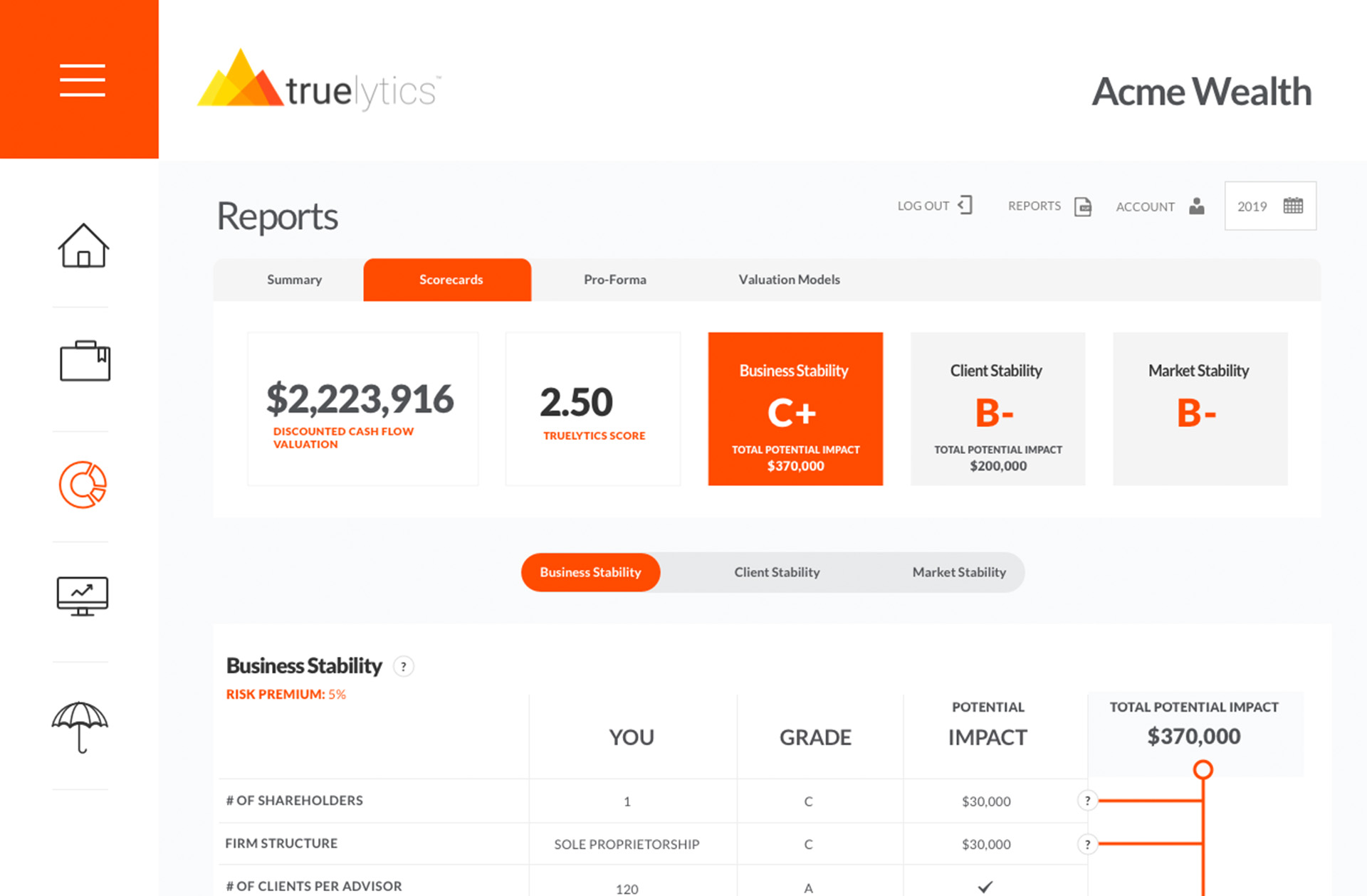

Key Performance Indicators (KPIs) allow you to take an objective look at the health of your business, as well as benchmark yourself against your peers – and the actionable nature of KPIs allows for continuous practice improvement. Once you understand the drivers and how they impact your value, you can then make incremental changes to your business to increase value and profitability, as well as capitalize on the strengths or fix the weaknesses. KPIs allow you to measure success, plan for succession, and improve your bottom line, all while helping you manage your business through its lifecycle.

Let’s look at ten of the top KPIs that impact your valuation – we’ll illustrate where the industry average falls, explain what the “ideal” metrics are and why, and provide actionable advice for your practice. Keep in mind, these represent only a portion of the KPIs that affect your overall value.

#1 – Firm Structure

Many advisors are merely managing a book of business, rather than treating their book as an actual business. As such, most advisors typically have a sole proprietorship and the advisor is filing a Schedule C for tax purposes (though, if you’re a broker dealer rep, your corporate entity would still be a disregarded entity and you’ll continue to file a Schedule C). Sole Props are the most common and simplest form of business entity. While this may indeed work for a “lifestyle practice”, the complete identity of the business lies with its owner and oftentimes does not meet an entrepreneur’s long-term objectives. Disadvantages include: unlimited and unshared liability, lack of stock, limited resources, and upon the death of the Owner, the “business” also dies (and will be disposed of according to the terms of the owner’s will). Additionally (and in our opinion, most importantly), there is no “business” to sell or transition – there is no actual legal structure in place to support or facilitate it.

Solution: Any type of business entity (other than a Sole Prop) will create a structure that allows for the future transition of ownership and value. These include: an S-Corporation, a C-Corporation, a Limited Liability Company (taxed as either an S-Corp or Partnership), or a Partnership (either General or Limited). Each structure has its pros and cons depending on your long-term objectives and it is recommended that you work with a tax professional to determine the correct choice for your specific needs and situation. Bottom line, the lack of a formal legal entity will negatively impact valuation and is perhaps one of the easiest “fixes” to make.

#2 – Interim/Emergency Continuity Plan

Industry statistics reveal that roughly only 27% of advisors have an interim or emergency continuity plan in place in case of an unforeseen event (death or disability). This means that a plan doesn’t exist that will allow a business to continue should something happen to more than 70% of the industry! We’d all like to think that the unthinkable can’t or won’t happen to us… yet, it seems many of us know or know of an advisor that it has happened to. The lack of an emergency continuity plan harms you, your family, your staff, and your clients. In fact, when an advisor passes away suddenly, studies show that revenue drops 60% almost immediately when a plan doesn’t exist. You’ve worked so hard to build your business – put a plan in place to protect it.

Multiple options exist to serve as a continuity plan:

Solution: There is no excuse to not have an interim plan. Put one in place.

#3 – Recurring Revenue Percentage

The industry’s average recurring revenue percentage is 72%. Over the years (especially with the proposed DOL rule a few years ago), we’ve seen a shift away from non-recurring (or commission) revenue – one that we believe will continue. The impending elimination of retail commissions (by Schwab, TD, and others) has confirmed this. Simply put, recurring revenue is more valuable because it’s more reliable.

Ideally, a firm’s recurring revenue should be 80% or more. Additionally, a diversified revenue stream is highly attractive. Advisors that charge for financial planning (above and beyond advisory fees) enjoy a revenue stream that isn’t tied to the market – and that has a huge, positive impact on valuation.

Solution: Start shifting your business model away from non-recurring revenue and focus more on a fee-based one, or better yet – one that’s not based solely on market performance.

#4 – EBOC Margin

The EBOC margin (Earnings Before Owners Comp, compared to revenue) is approximately 28% for most firms. (The EBOC number normalizes owner comp/perks to eliminate anything above and beyond a management replacement salary, i.e., what a potential Buyer could pay someone to do your job.) This metric is typically the greatest indicator of a firm’s profitability (and represents the free cash flow a business generates).

A firm that is considered to be a “well run” firm will boast an EBOC margin of 40-50%. That’s a huge jump in profitability compared to 28%! Keep in mind that your EBOC margin can be too high – which means you might not be properly investing in your business.

Solution: To increase your EBOC margin, start by looking at the revenue coming in and see if improvements can be made (#5 addresses this). Next, take a hard look at your expenses. It’s easy to fall into the pattern of paying a bill year after year without questioning it. Chances are you can trim expenses somewhere. But keep it realistic; cutting necessary and reasonable expenses isn’t going to positively affect your true bottom line. And don’t make the mistake of taking a K1 distribution in lieu of a salary to show a higher number either (because you’ll end up subtracting a management replacement salary from your cash flow anyway to normalize expenses). With incremental changes over time, you can improve the financial snapshot of your business.

#5 – Revenue/AUM (bps)

Most advisors charge an average of about 75 basis points, and we often see fees lower than 60 bps (some firms even advertise themselves as a “low-cost provider”!). Though there is some scrutiny and debate over this (especially with previous DOL considerations), the ideal fee is 1% (100 bps) or more. Bottom line, your firm is not valuable if you’re not charging enough for your services.

Solution: Don’t sell yourself, and the valuable advice you provide, short. Gradually raise your fees if you’re not charging enough by industry standards. Don’t drop your fees (i.e., lower your standards) just to get a new client. Even better, diversify your revenue stream and charge for financial planning (like we discussed in #3). The right clients understand and see the value you provide and are willing to pay for it. And your business becomes more valuable in the process.

#6 – Average Client Age

The average age of advisory clients is 62 (the ramifications from the aging Baby Boomer generation just keep coming). As these clients move into retirement (read: distribution phase), there is a huge impact on your business – without adding younger clients, your business becomes a depreciating asset! Think about it, more assets will be going out than are coming in.

The average client age you want to set as a goal is 55 or younger – those that are in accumulation phase. These clients are the future of your business.

Solution: In addition to marketing to younger potential clients, focus on building next generation relationships with your existing clients’ heirs (we’ll talk more about this in #9).

#7 – Client Addition/Departure Rates

Here’s a fact – advisors can very easily become complacent. It’s very common to set an established firm on cruise control and lose focus on what is an ever-changing business (because let’s face it, our industry is ever-changing). But continuing to work on a business (rather than just ‘in’ it) is paramount to intrinsic value.

Statistically, the average annual client addition rate is 4% and the loss rate is 2% (including deceased clients). I imagine that without action, this gap will likely close and even swing the other direction as the Baby Boomer generation continues to age. Ideally, firms should be growing their client base by 6-8% every year and only losing 1%.

Solution: As your clients age and pass away (and you lose those assets), you need to be replenishing them at a faster rate than you’re losing them. For a business to really thrive, it needs to be constantly growing – taking your eyes off of firm growth is never an option. Think “add” rather than “replace”.

#8 – Percentage of New Clients from Existing Client Relationships

Speaking of client addition rates, most advisors grow their businesses predominantly through existing client referrals – it usually accounts for approximately 75-80% of new clients. While this is a great thing while your business is in growth mode, it becomes a detractor when it comes time to think about transitioning your business… especially if those referral relationships are tied to one individual.

In a perfect world, only 40-50% of new clients should come from existing client referrals. Anything greater than that means you’re not properly utilizing centers of influence (COIs). It also means that you’re passively growing your business, when you should actively be searching out new business (i.e., marketing).

Solution: You should always be marketing and promoting your business and services. In his book “The Game of Numbers”, Nick Murray preaches that you should never stop prospecting. When it comes to growing your business, prospecting is your sweat equity. People and relationships are our business. Clients will come and clients will go – but it is your responsibility to make sure you never stop actively looking for new clients.

#9 – Percentage of Next Gen Relationships

Currently, most firms only have relationships with about 20-25% of their clients’ next gen. The assets from your older clients will eventually transition and if you’re not working to build a relationship with their beneficiaries, you will lose those assets. You should ideally know (or have at least been introduced to) 60-70% of your clients’ next gen.

Solution: Start building next gen relationships today. Hold (at least) annual multi-generational, family-style client events. Ask to be introduced to the kids or whoever stands to inherit those assets. Unlike when we were growing up, schools today don’t teach kids about things like how to balance a checkbook. That’s a great opportunity to strengthen the relationship with your clients and their kids/grandkids. It does involve making an investment in the future and it may take some time for you to see the return on that investment (e.g., hours spent educating the next gen), but it is an investment that will come to fruition when there’s minimal risk of assets leaving your firm.

If you’re near age 60 or older, consider utilizing (read: hiring) young talent to support these relationships (how cool would it be if your successor were in charge of building the relationships with your clients’ successors?). After all, who understands the millennial generation and what they want better than another millennial?

#10 – Percentage of AUM from top 5 relationships

For advisors, the top five relationships comprise, on average, about 20% of revenue. This means that if you were to lose one or two of those clients, for whatever reason, you would lose a significant portion of your revenue. That’s just way too risky. As such, those top five relationships should only represent 10% (or less) of your revenue.

Solution: Yes, clients that invest a lot of their personal wealth with you are attractive and highly desired. But you need to balance out those higher net worth amounts across your entire client base. It’s smart to set a minimum investable amount for the clients you’ll take on. If you don’t already do this, start by looking at your top 10 relationships. If they’re all around $2m, you’ll probably want to set your minimum at $750,000 or $1m. Ideally, you want to close the gap between your biggest and smallest clients. Once you’ve set the minimum, stick to your guns (except in special situations, i.e., next gen, family accounts, etc.). If you have a significant number of clients that fall below the threshold, start shedding those accounts or explain your AUM policy and ask if they have additional assets they’d like to invest with you.

Conclusion

As you can see, KPIs can have a significant impact on value and give you the ability to understand your entire business based on its unique characteristics. Armed with some of this knowledge, you can identify and determine which factors should receive the most attention as you work to improve the risk profile of your firm (thus increasing value).

Most importantly, don’t count any action or change as too small or not worth it – even though these changes may be minor and incremental, over time and taken collectively, they have the potential to materially affect the business.

Lorem ipsum dolor sit amet, consectetur adipiscing elit

These Stories on Practice Management