This past December, Truelytics rolled out benchmarking as a new feature available to all members. At that time we offered views for your Truelytics Score, Valuations, and Expenses. We are pleased to announce that we have added client and revenue benchmarks.

Client Benchmarks

A firm's client base is its lifeblood. It is essential to have a diversified client base, frequent interactions with your clients, and to build relationships with the next generation of wealth. The client data we benchmark all factor into your Client Stability Score which reflects the demographics and turnover of your client base.

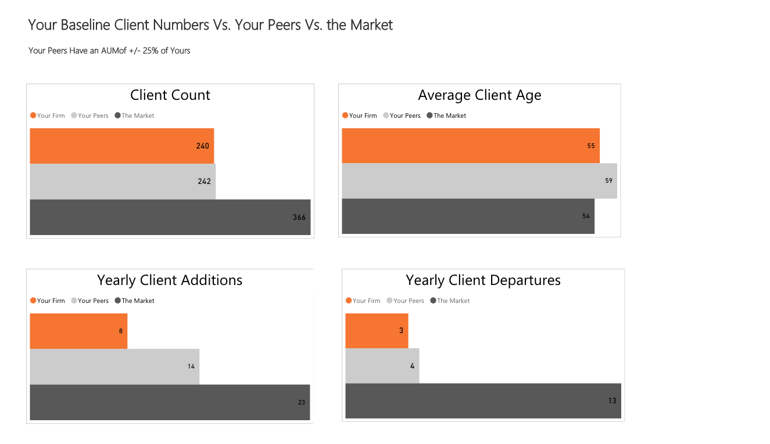

Your Baseline Client Numbers Vs. Your Peers Vs. the Market

This view shows how you stack up against your peers (AUM of +/- 25% of yours) and the market (our entire data set.) for the following measures:

- Client Count: Finding the right number of Clients to work with is almost like playing Goldilocks; you need to find the number that is “just right”. Too many clients and you risk exceeding capacity and not being able to achieve scale. Too few clients and the sustainability of your firm comes into question.

- Average Client Age: A firm’s average client age is usually pretty closely matched to their average advisor age. This statistic causes concern, however, when the client age is greater than 50-55 years old. As the client base ages, the impact of distributions for those in retirement can greatly (read, negatively) affect the value of the firm. Without adding younger clients to drive down the average age, your asset (your business) can easily become a depreciating asset, with more AUM going out than coming in.

- Yearly Client Additions: In tandem with the above points, be sure that you’re adding the right clients. Firms that add clients just to increase their AUM, without a specific growth plan, risk it being an exercise in futility. Be careful about growing too fast as well. A well-thought out client acquisition strategy is beneficial to your firm’s profile when properly executed.

- Yearly Client Departure: The fact is, you’re going to lose clients from time to time. It’s unavoidable; but it can be managed. Well diversifying your client base will lessen the impact from those that may pass away. Also, be certain that you’re not working with too many clients (there’s that capacity concern again) that you don’t risk attrition by not meeting expectations.

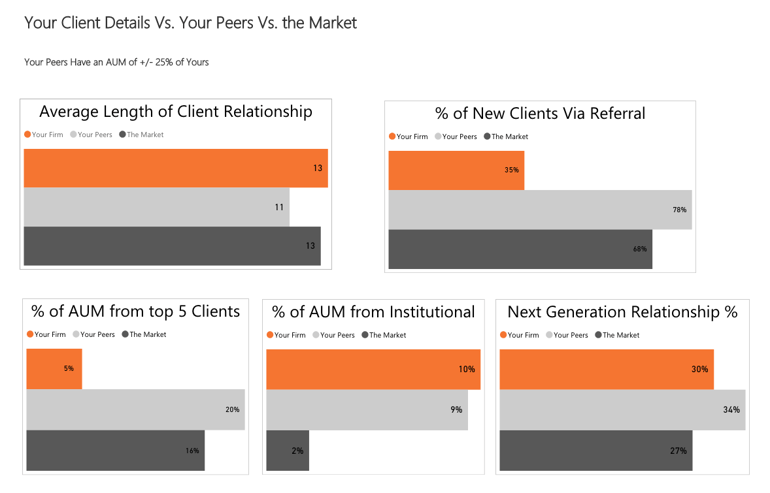

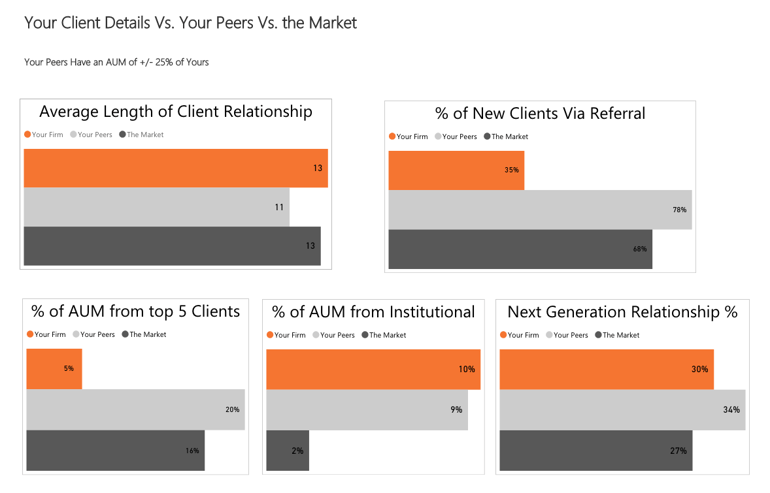

Your Client Details Vs. Your Peers Vs the Market

This view shows how you stack up against your peers (AUM of +/- 25% of yours) and the market (our entire data set.) for the following measures:

- Average Length of Client Relationship: Clients that are loyal for life are great for business. But when your average client tenure exceeds 12-15 years, you must question whether a firm is adding enough younger clients or has stopped growing all together. Be sure to find a healthy balance when examining the demographics of your client base.

- % of New Clients Via Referral: Ideally, no more than 30% of your new clients should be gained through existing client referrals. This “ideal” statistic is often surprising for advisors, as referrals are often the genesis of new relationships. However, a percentage higher than 30% indicates that you’re not properly using your centers of influence (COIs) or doing enough external marketing. While referrals do indicate you’re properly servicing your existing clients, they’re much too passive of a way of growing your business.

- % of AUM from Top 5 Clients: Clients with significant assets tend to excite advisors. Especially when a firm can boast several high net worth households. However, if your top five clients make up more than 10-15% of your total AUM, you’ve put yourself at risk for having considerable asset (and revenue) loss should one (or more) of those clients decide to leave (whether it’s for service reasons or as the result of a transition to the next gen).

- % of AUM from Institutional: As with your top clients, institutional relationships are important to your business. But they also shouldn’t represent more than 10-15% of your AUM. Always be sure that you’re diversifying your client base, just as you would diversify a portfolio for your clients.

- Next Generation Relationships: Aging baby boomers and the impending transition of wealth to the next generation are certainly cause for concern. It is imperative to foster relationships with your clients’ next of kin (even if they don’t currently meet AUM levels to be a client). You should ideally have at least made an introduction to 40-50% of your clients’ children. With the ever-increasing mortality age, by the time your clients transition their wealth, chances are their children already have their own advisor – and it probably isn’t you. Start developing these relationships early (much earlier than you would initially think).

Revenue Benchmarks

Understanding your revenue mix allows us to estimate the stability of your projected revenues. It also allows us to estimate the risk due to exposure to market fluctuations.

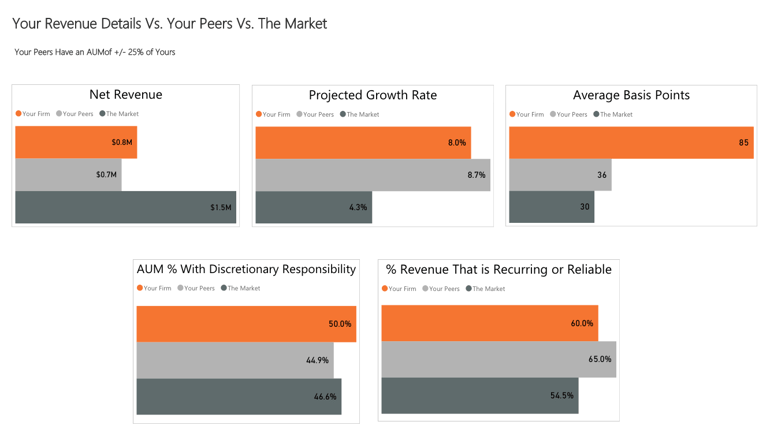

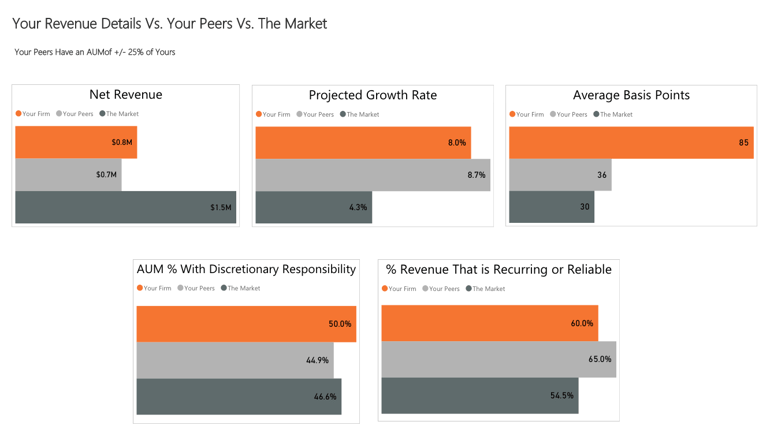

Your Revenue Details Vs. Your Peers Vs. The Market

This view shows how you stack up against your peers (AUM of +/- 25% of yours) and the market (our entire data set.) for the following measures:

- Net Revenue: As a general rule of thumb, your net revenue should be approximately 1% of your AUM. Additionally, it’s always wise to diversify your revenue stream in a way that isn’t necessarily tied to market performance. Charge for financial planning or tax preparation to make sure that your firm can generate sufficient revenue in the event of a market downturn or correction.

- Projected Growth Rate: On average, most firms enjoy an 8-10% year-over-year growth rate that blends both market and organic growth (don’t forget that distributions for your retired clients will negatively impact this). Significant growth (>20%) isn’t sustainable, even for newer firms, and a growth rate of less than 5% often raises questions around the firm’s trajectory. Find a healthy (and realistic) growth number and incorporate the strategy into your annual business plan.

- Average Basis Points: Closely tied to net revenue, we generally like to see firms charge approximately 100 basis points. Anything much lower than that (especially <60 bps) and we often question the profitability and sustainability of the firm – while revenues fluctuate with market performance, expenses are generally fixed. Again, charging an additional fee for financial planning is monumental when measuring the impact of this metric.

- AUM % with Discretionary Responsibility: Whether in-house or through a third party portfolio manager, discretionary responsibility tends to indicate a strong client-advisor relationship and level of trust (translation: very sticky assets). Ideally, we like to see a statistic of 70-75% for discretionary responsibility as it typically improves the stability of a firm’s revenue.

- % Revenue That is Recurring or Reliable: Similar to discretionary assets, recurring revenue is more “valuable” than non-recurring (if you use a rule-of-thumb revenue methodology, recurring revenue is generally 2x and non-recurring is 1x). Again, a minimum of 70-75% recurring revenue is desired to indicate overall good health and stability of a firm’s cash flow.

Truelytics intends to roll out 1-2 new sets of benchmarks every month. Stay tuned!

More articles related to: Truelytics