What do Zillow, Expedia, Glassdoor, and Truelytics have in common? Well, of course we are sexy tech platforms that disrupt the industries we are part of. What else? Give up? We all create unique content and index an industry online (homes for Zillow, hotels and flights for Expedia, companies for Glassdoor, financial advisory firms for Truelytics).

In an effort to unlock the real potential of over one million data points generated from the 8,000+ firms on our platform, Truelytics has developed a powerful analytics engine to set a new standard for how benchmarking gets done in the wealth management industry.

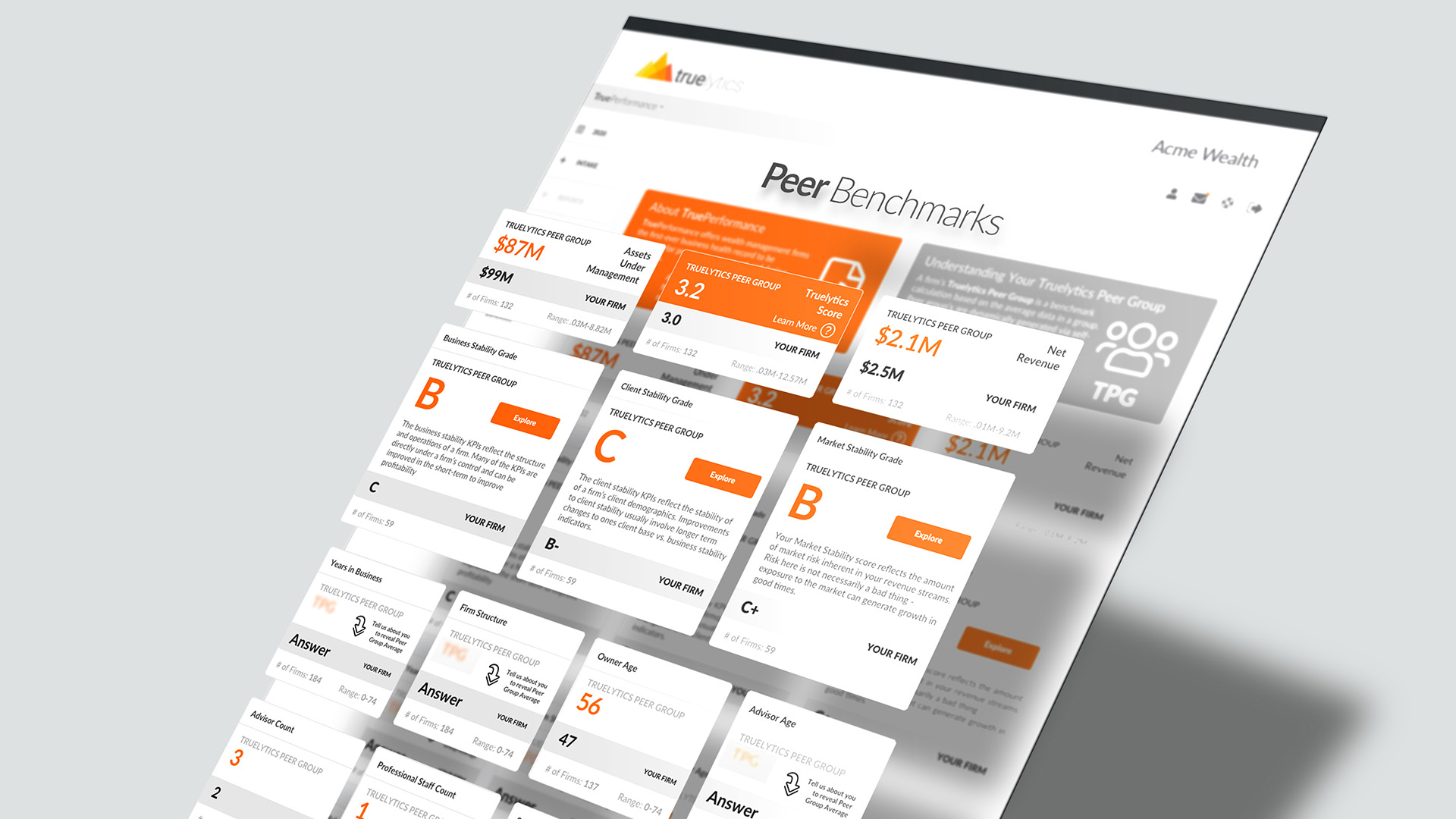

Upon logging in, new users are now introduced to the Truelytics Peer Group Benchmark dashboard. Keying off the firm’s assets under management (AUM), Truelytics assigns them to a peer group and serves up the following benchmarks:

Firms are offered the ability to explore the main drivers of their business, client, and market stability grade benchmark. Each answer they provide around the following categories presents them with new insights while also refining their peer group, all in real-time:

For each answer you provide data, you get your peer group’s corresponding benchmark instantaneously. In addition, every answer you provide will automatically populate that specific data point in the formal Truelytics intake. By completing your Peer Benchmark you will have also completed 30% of your Truelytics eValuation, without having to re-enter anything.

As detailed above, the Truelytics Peer Group Benchmark Dashboard contains over 30 clearly labeled modules.

This is the average peer group benchmark that is calculated from the range of answers provided by the total number of firms in the peer group (see Stats).

This is the answer provided by the firm. If the Peer Group section is blurred out, it is because a firm needs to provide data about themselves in order to reveal the benchmark.

Details about the total number of firms that make up the peer group for each category and the range of data provided by those firms.

Glad you asked! Our new analytics engine has many applications across our existing platform and via a brand new property we launched earlier in August.

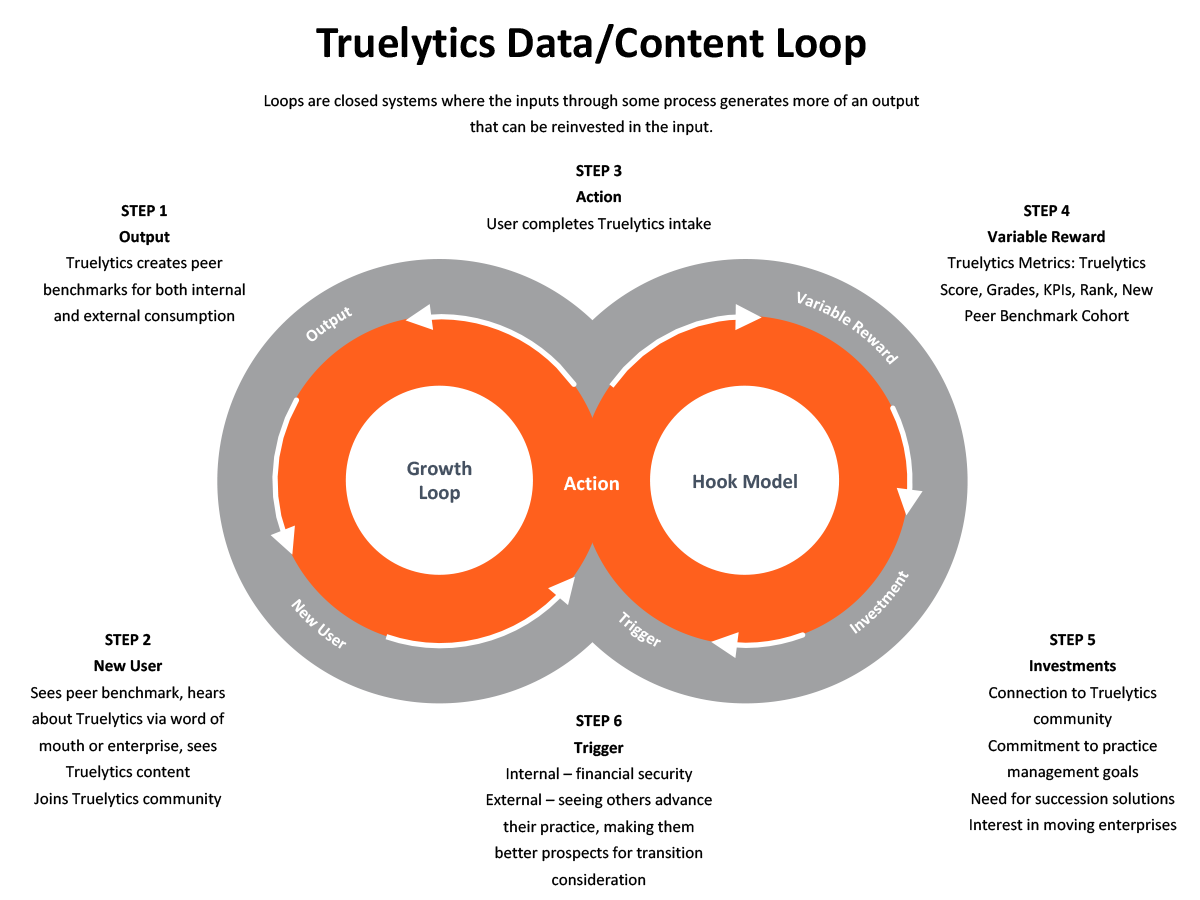

As the largest database of business health records for independent financial advisory firms in the world, TruePerformance is the fuel for our new analytics engine. However, we have gone beyond simply unleashing the overall scale of our dataset to introduce easy-to-understand KPIs with very little effort on behalf of the user. We have architected our solution to be a dynamic feedback loop. The more data shared, the more everyone on the platform benefits, instantaneously. No more waiting for annual benchmark studies to get published. No more paying high-priced consultants for access to this type of information. A firm may contribute as much or as little as they like and still derive meaningful insights. Regardless which path they choose, they will be contributing to a universal data set for others to benchmark themselves against, by submitting their own information.

The Truelytics Peer Group Benchmarks are currently being included in the development of TrueMatch, our online matching making solution for planned succession events. Specifically, it is being added as a profile element, where it will sit between buyer/seller attributes and a firm’s eValuation.

Currently, TrueRecruit offers enterprises the ability to securely move their entire recruitment intake online. In our next release, we plan to start the whole intake process with the Truelytics Peer Group Benchmark Dashboard to help recruiters quickly assess what other firms of similar size look like via the Truelytics data set.

In August, we launched RIAbase.com as the most comprehensive benchmarking solution for Registered Investment Advisors (RIAs) in the wealth management industry. The site contains benchmark dashboards for over 13,646 RIAs in the United States mapped against data from both the SEC and Truelytics.

We anchor both the SEC and Truelytics benchmarks against a firm’s self-reported and publicly available AUM they submit annually to the SEC via the Form ADV. The SEC data is bucketed into the following three groups:

The Truelytics RIAbase Benchmarks are the same as what we offer in TruePerformance. In addition, we allow firms to claim their RIAbase page, as well as follow other firms and receive alerts when something changes on the tracked pages. This allows them to update the information displayed and keep their Truelytics benchmarks/peer group up to date. There are plans in the work to offer a pro subscription package, which would allow users to create groups of firms they wish to follow, download data, etc.

Conclusion

Truelytics' new analytics engine is our first step at democratizing the data of over 20,000+ firms currently on our platform or registered with the SEC. Our future plans include doing the same with the 250,000+ registered reps and the 50,000+ wirehouse advisors located in the United States.

Even though we are only showing several dozen benchmarks via Truelytics.com and RIAbase.com, behind the scenes our analytics engine is calculating similar reports for every data point in our system. In the future, we'll allow our data partners to craft their reports based on custom filters and handpicked data points.

As our data set grows Truelytics will continue to find ways to make our data set easier to access and consume. This is central to our mission of helping financial advisory firm's identify and access opportunity.

These Stories on Product Release Notes